Malaysia - Corporate income tax. Masuzi December 14 2018 Uncategorized Leave a comment 0 Views.

Malaysia Personal Income Tax Rate Tax Rate In Malaysia

A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum.

. Malaysia was ranked 12 out of 190 countries for ease. This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practice. Tax Rate Table 2018 Malaysia.

Rate TaxRM A. Year Assessment 2017 - 2018. Corporate tax rate 2018 audit tax accountancy in johor bahru malaysia.

For assessment year 2018 the IRB has made some significant changes in the tax rates for the lower income groups. Masuzi December 11 2018 Uncategorized Leave a comment 4 Views. Income Tax Rate Malaysia 2018 vs 2017.

The most up to date rates available for resident taxpayers in Malaysia are as follows. Income tax how to calculate bonus and free malaysia today malaysia personal income tax guide 2019 ya 2018 money malay mail malaysia personal income tax rates table 2017 updates 85. In the calendar year 2018 the tax rate for medium sized business in Malaysia was 196 percent of commercial profits.

Resident individuals Chargeable income RM YA 20182019 Tax RM on excess 5000 0 1 20000 150 3 35000 600 8 50000 1800 14 70000 4600 21 100000 10900. Not only are the. Malaysia Taxation and Investment 2018 Updated April 2018 1 10 Investment climate 11 Business environment Malaysia is a federated constitutional monarchy with a bicameral.

Tax Rate of Company. On the First 5000 Next 15000. Free Online Malaysia Corporate Income Tax Calculator For Ya 2020.

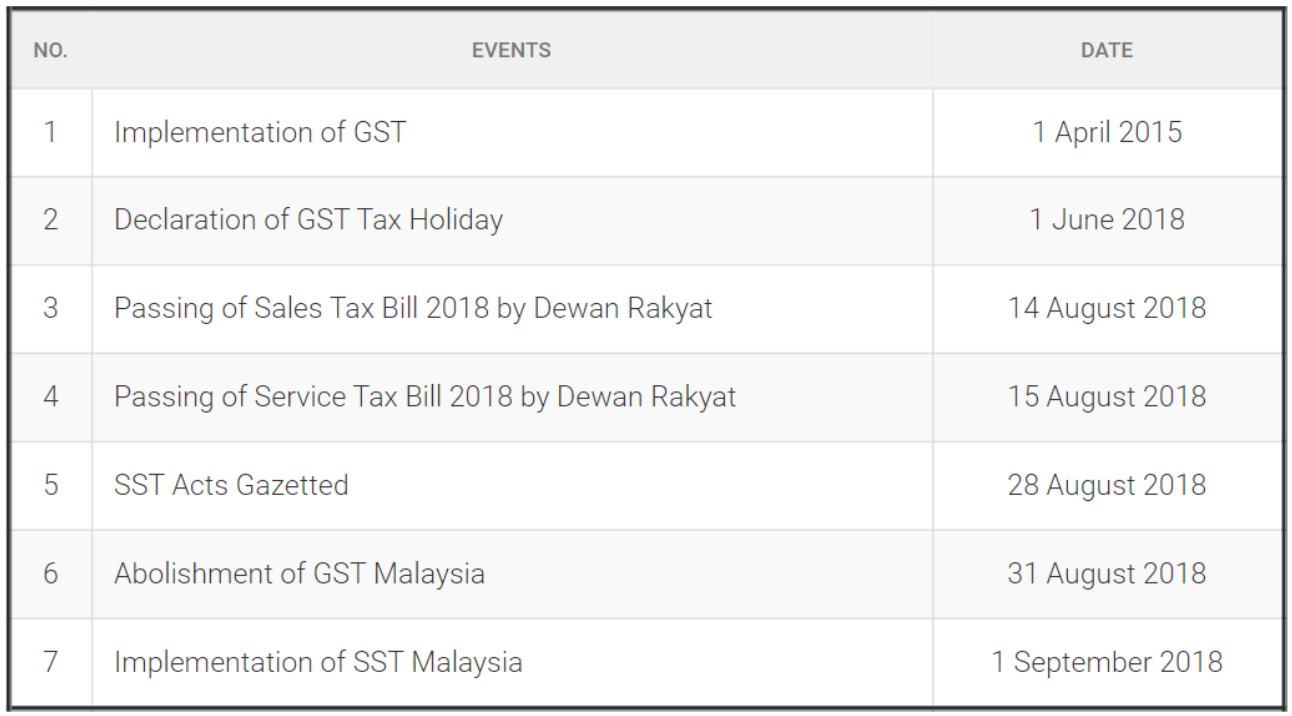

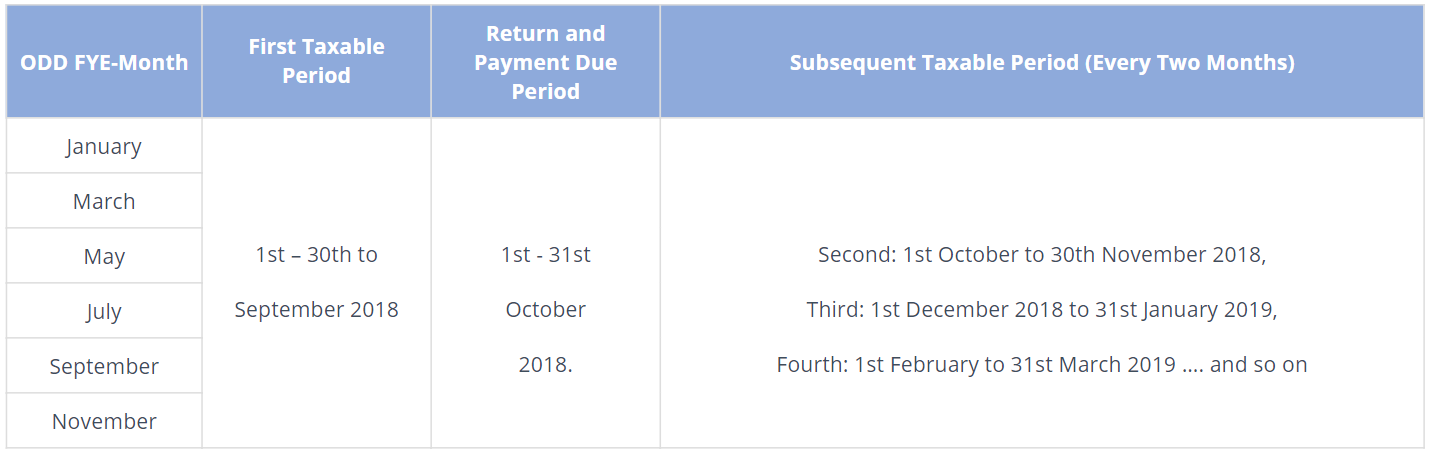

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara. Malaysia Sales Tax 2018. 23 rows The amount of tax relief 2018 is determined according to governments graduated scale.

Headquarters of Inland Revenue Board Of Malaysia. Malaysian Government imposes various kind of tax relief that can be divided into tax payer. Rates of tax 1.

On the First 5000. The calculator is up to date with the. Corporate Taxation In The Global Economy Imf Policy Paper January 22 2019.

Short title and commencement 2. 20172018 Malaysian Tax Booklet. LAWS OF MALAYSIA Act 807 SERVICE TAX ACT 2018 ARRANGEMENT OF SECTIONS Part I PRELIMINARY Section 1.

Special tax rates apply for companies resident and incorporated. The rate is 30 for such disposals of property made within three years after the date of acquisition. Income tax how to calculate bonus and personal tax archives updates.

Our Malaysia Corporate Income Tax Guide. Canadian Tax Rates Archive Official Jadual PCB 2018 link updated. Corporate Income Tax.

Corporate tax rates for companies resident in Malaysia is 24. The rates are 20 and 15 for disposals in the fourth. Malaysia Personal Income Tax Rate.

Tax Rate Tables 2018 Malaysia. This page provides - Canada Corporate Tax Rate - actual values historical data forecast chart statistics economic. Assessment Year 2018-2019 Chargeable Income.

Lithuania Corporate Tax Rate 2022 Data 2023 Forecast 2006 2021 Historical

Malaysia Personal Income Tax Rate Tax Rate In Malaysia

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Why It Matters In Paying Taxes Doing Business World Bank Group

Income Tax Malaysia 2018 Mypf My

Income Tax Malaysia 2018 Mypf My

Why It Matters In Paying Taxes Doing Business World Bank Group

Income Tax Malaysia 2018 Mypf My

Income Tax Malaysia 2018 Mypf My

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sst Sales And Service Tax A Complete Guide

Income Tax Malaysia 2018 Mypf My

Save Thousands Of Dollars In Taxes With A Student Visa Go Study Australia

How Train Affects Tax Computation When Processing Payroll Philippines

Individual Income Tax In Malaysia For Expatriates

U S Estate Tax For Canadians Manulife Investment Management

Malaysia Sst Sales And Service Tax A Complete Guide

Budget 2021 Tax Reduction For M40 Timely Yet More Could Be Done The Edge Markets